Gross Annual Income Of 28000

Annual gross income 30000. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Canadas Federal Taxes are calculated using the latest Personal Income Tax Rates and Thresholds for Ontario in 2021.

Gross annual income of 28000. In total from 199900 to 201819 PCSs gross annual income rose by approximately 9 million British pounds. Gross Income for Tax Purposes. Annual gross income 15000.

A minimum base salary for Software Developers DevOps QA and other tech professionals in Portugal starts at 15000 per year. You can read more about it in the gross to net calculator. Gross annual income calculator.

It includes services received and property. For a particular year a company has gross annual income of 780000 annual expenses of 270000 and allowed depreciation of 60000. 840 0000.

Net annual salary Weeks of work year Net weekly income. 895 0000. Find tech jobs in Denmark.

Our salary calculator indicates that on a 28000 salary gross income of 28000 per year you receive take home pay of 22702 a net wage of 22702. By admin on 21 June 2019. 28000 Salary Take Home Pay.

At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a. What is a 28k after tax. 2360540 net salary is 2800000 gross salary.

Gross income is not limited to cash payments. De très nombreux exemples de phrases traduites contenant gross annual income Dictionnaire français-anglais et moteur de recherche de traductions françaises. A minimum base salary for Software Developers DevOps QA and other tech professionals in Denmark starts at 30000 per year.

Gross annual income - Traduction française Linguee. The total tax you owe as an employee to HMRC is 5298 per our tax calculator. This period was rather erratic in terms of income for PCS.

Your gross annual income is the amount of money you earn in a year before tax and includes all your income sources. If your salary is 28000 then after tax and national insurance you will be left with 22680This means that after tax you will take home 1890 every month or 436 per week 8720 per day and your hourly rate will be 1345 if youre working 40 hoursweek. For businesses gross income is identical to gross margin or gross profit.

Based on a 40 hours work-week your hourly rate will be 1345 with your 28000 salary. Gross Annual Salary. Low Income Tax Offset LITO 70000.

See how we can help improve your knowledge of Math Physics Tax Engineering and. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. Assuming that incomes are.

The first four fields serve as a gross annual income calculator. One of a suite of free online calculators provided by the team at iCalculator. The Table below illustrates how Ontario Income tax is calculated on a 2800000 annual salary.

Traductions en contexte de gross average annual income en anglais-français avec Reverso Context. A one person household with a gross annual income of 28000 would receive a Financial Assistance allowance of 80 as they would be below the 80 income limit of 32200 but above the 100 income limit of 25760. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

The result in the fourth field will be your gross annual income. Gross income is money before taxation. Income Income Period.

If you earn 28000 a year then after your taxes and national insurance you will take home 22680 a year or 1890 per month as a net salary. The company is located in a state where the first 200000 corporate income is tax-free and any income 35711 results statistics. Scroll down to see more details about your 28000 salary Income Income Period.

A survery of 80 randomly selected companies asked them to report the annual income of their presidents. In total from 199900 to 201819 GMBs gross annual income grew by approximately 29 million British pounds during this time period peaking in. Total Income Tax Due.

10740 0000. This net wage is calculated with the assumption that you are younger than 65 not married and with no pension deductions no childcare vouchers no student loan payment. Formula for calculating net salary.

At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a. Low and Middle Income Tax Offset LMITO 25500. Data on the total annual gross income of Public and Commercial Services Union PCS in the United Kingdom UK from 199900 to 201819 shows that at the start of this period gross income was over 25 million British pounds.

Data on the total annual gross income of the General Municipal Boilermakers and Allied Trade Union GMB in the United Kingdom UK from 199900 to 201819 shows that at the start of this period gross income was over 46 million British pounds. 28000 Federal and State Tax Calculation by the US Salary Calculator which can be used to calculate your 2021 tax return and tax refund calculations. For the 2019 2020 tax year 28000 after tax is 22576 annually and it makes 1881 net monthly salary.

Find tech jobs in Portugal. From 1999 to 2004 NWCFLs gross average annual income was approximately 950000 though when expenses were subtracted Co-operative was behind about 45000 to 50000 per year. 10074 0000.

As printed on their income statement a companys gross income is the revenue earned from all sources minus.

Salary Net Salary Gross Salary Cost To Company What Is The Difference

30 000 After Tax After Tax Calculator 2019

20 000 After Tax 2021 Income Tax Uk

Agi Calculator Adjusted Gross Income Calculator

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Vs Net Income Financial Infographic From Accc Learn More About Personal Finances To Better Mana Net Income Debt Relief Programs Credit Card Debt Relief

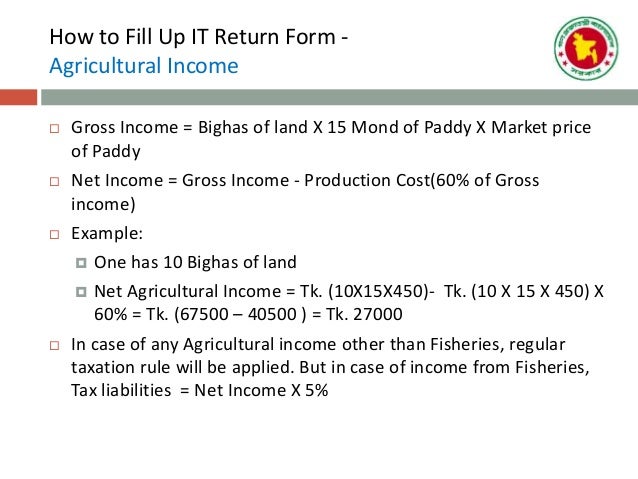

General Presentation On Income Tax In Bangladesh

Gross Income Inclusions And Exclusions Gross Income Life Insurance

Annual Income Learn How To Calculate Total Annual Income

The Tax Burden Across Varying Income Percentiles Adjusted Gross Income Income Tax

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Annual Income Learn How To Calculate Total Annual Income

Module 8 Exclusions From Gross Income Studocu

Inss The Brazilian Salaries And Benefits Bpc Partners

France Salary Calculator 2021 22

Post a Comment for "Gross Annual Income Of 28000"