Net Salary Calculator Ohio

What salary does a NET earn in Ohio. One of a suite of free online calculators provided by the team at iCalculator.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Net annual salary Weeks of work year Net weekly income.

Net salary calculator ohio. First of all no matter what state you live in your employer withholds 62 of your earnings for Social Security taxes and 145 of your earnings for Medicare taxes. The US Salary Calculator includes Federal and State income tax medicare social security capital gains and other income tax and salary deductions complete with supporting income tax tables. Formula for calculating net salary.

Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Ohio paycheck calculator. Can be used by salary earners self-employed or independent contractors. That means that your net pay will be 40568 per year or 3381 per month.

376 NET Salaries in Ohio US provided anonymously by employees. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

After this you will pay 20 on any of your earnings between 12571 and 50270 and 40 on your income between 50271 and 150000. The adjusted annual salary can be calculated as. Well do the math for youall you need to do is enter the applicable information on salary federal and state W-4s deductions and benefits.

To use our Ohio Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This marginal tax rate means that your immediate additional income will be taxed at this rate. How to use the Take-Home Calculator.

See how we can help improve your. The free Ohio salary payroll calculator below is frequently updated with the most up-to-date tax data and gives you a consistently accurate way to calculate an employees net pay. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary.

Anything you earn above 150000 is taxed at 45. Using our Ohio Salary Tax Calculator. One of a suite of free online calculators provided by the team at iCalculator.

How to calculate annual income To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay. Find out the benefit of that overtime.

The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. See how we can help.

How to calculate taxes taken out of a paycheck. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month. Enter the number of hours and the rate at which you will get.

Also explore hundreds of other calculators addressing topics such as tax finance math fitness health and many more. The Ohio Salary Calculator allows you to quickly calculate your salary after tax including Ohio State Tax Federal State Tax Medicare Deductions Social Security Capital Gains and other income tax and salary deductions complete with supporting Ohio state tax tables. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

You will get a 14-page downloadable report calculating the salary youll need. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. This independent calculation will help you justify your salary demands in your.

This is known as your personal allowance which works out to 12570 for the 20212022 tax year. Paycheck Results is your gross pay and specific deductions from your paycheck Net Pay is your take-home pay and Calculation Based On is the information entered into the calculator. The calculations are even tougher in a state like Ohio where there are state and often local income taxes on top of the federal tax withholding.

Below are your Ohio salary paycheck results. Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Ohio. 30 8 260 - 25 56400.

Your average tax rate is 220 and your marginal tax rate is 353. The United States Salary Calculator allows you to quickly calculate your salary after tax. Use the salary calculator above to quickly find out how much tax you will need to pay on your income.

Using 10 holidays and 15 paid vacation days a year subtract these non-working days from the total number of working days a year. After a few seconds you will be provided with a full breakdown of the tax you are paying. The results are broken up into three sections.

Calculate the salary that you will need in Cleveland Ohio based on the cost of living difference with your current city. All bi-weekly semi-monthly monthly and quarterly figures. For only 49 USD you will know the salary you need in Cleveland Ohio to maintain your current standard of living after you move.

All you have to do is input their annual salary along with the necessary state federal and local tax information. In order to determine an accurate. Ohio Salary Paycheck Calculator Results.

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Governor Mike Dewine Signs 2020 2021 Ohio Budget With Several Significant Tax Changes What To Look For Cohen Company

Paycheck Calculator Take Home Pay Calculator

Download Simple Child Support Calculator For Wordpress Free Wordpress Plugin Https Downloadwpfree Com Download S Supportive Daycare Costs Child Support

Paycheck Calculator Take Home Pay Calculator

What Is The Difference Between Gross Pay And Net Pay Ontheclock

Ohio Paycheck Calculator Smartasset

Ohio Payroll Tools Tax Rates And Resources Paycheckcity

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

This Is The Ideal Salary You Need To Take Home 100k In Your State

Free Online Paycheck Calculator Calculate Take Home Pay 2021

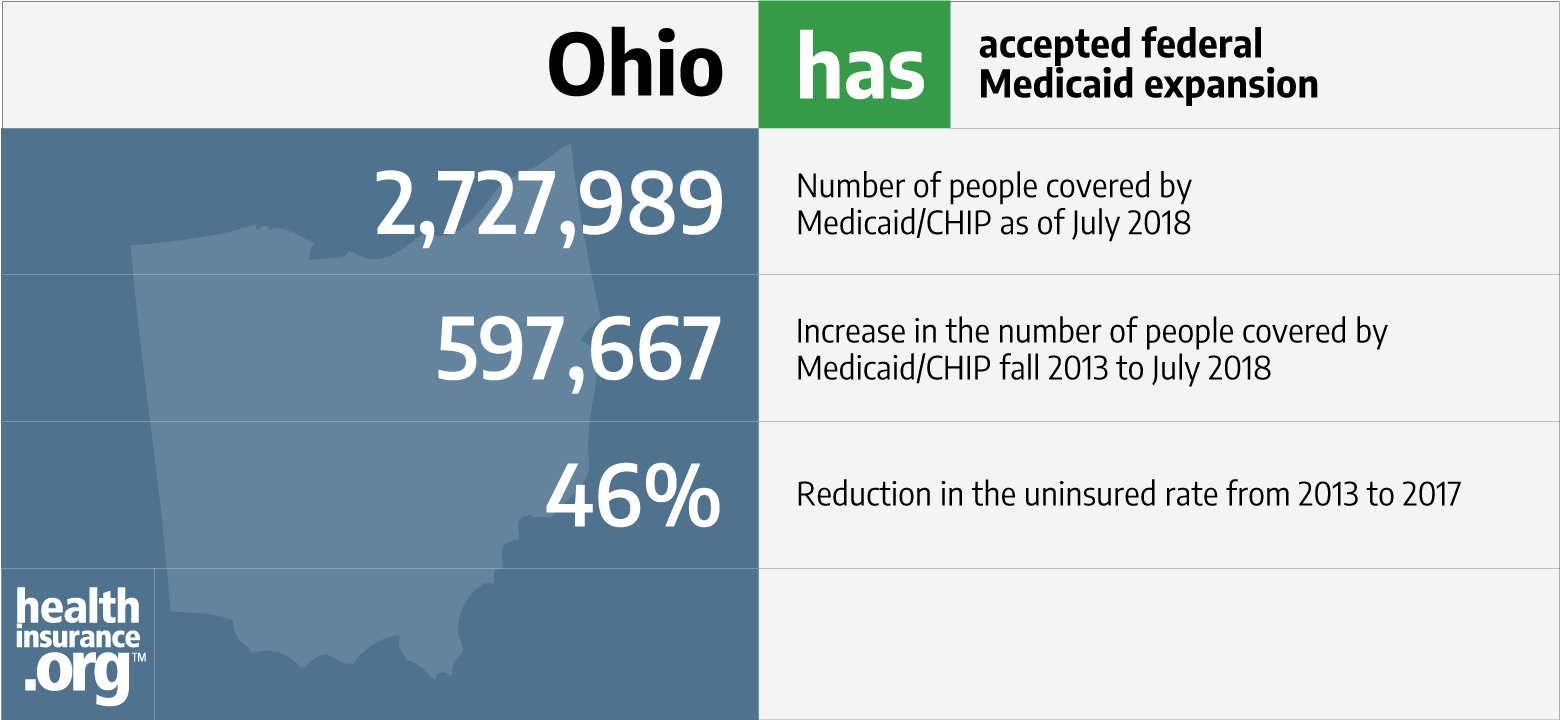

Ohio And The Aca S Medicaid Expansion Healthinsurance Org

Ohio Paycheck Calculator Smartasset

Municipal Sites Department Of Taxation

:max_bytes(150000):strip_icc()/AppleIncomeSattementDec2019-cd967d0a8f5e4748a1060f83a7e7acbc.jpg)

Post a Comment for "Net Salary Calculator Ohio"