Net Salary Calculator Geneva

Salary Before Tax your total earnings before any taxes have been deducted. That means that your net pay will be CHF 41602 per year or CHF 3467 per month.

Nopat Vs Net Income Here Are The Top Differences Between Nopat Vs Net Income It S Worth Looking At The Differences Net Income Income Net

The results do not represent wage recommendations.

Net salary calculator geneva. The average monthly net salary in the Republic of Ireland is around 3000 EUR with a minimum income of 1600 EUR per month. Calculate your individual contribution using our contribution calculator. Reposant sur un modèle statistique le calculateur de salaire en ligne permet destimer des fourchettes de salaire mensuel brut pour un profil individuel spécifique.

For only 50 USD you will know the salary you need in Geneva to maintain your current standard of living after you move. Net salary is is the result of initial pay including tax and other sorts of deductions made. The taxation in Ireland is usually done at the source through a pay-as-you-earn PAYE system.

Minimum salary is 500 EUR per month. Métier précédent Infirmierère Prochain métier. Déductions CHF par an.

The calculator accounts for Swiss OASIDIEO contributions unemployment insurance ALV contributions non-occupational accident insurance NOAI premiums paid sick leave. Enter Your Salary and the Switzerland Salary Calculator will automatically produce a salary after tax illustration for you simple. With direct grossnet conversion.

The Debt Consolidation. Salary Before Tax your total earnings before any taxes have been deducted. Select Advanced and enter your age to alter age related tax allowances and deductions for your earning in Switzerland.

The salaries are calculated based on salary indications of thousands of registered users on jobsch and help you to better understand what you can earn in which region and in which sector. Salaire net CHF par an. Salaire brut CHF par an.

Les estimations de salaire reflètent la situation du marché de lemploi dans le secteur privé pour le canton de son choix ainsi que pour lensemble de la Suisse. Our database already includes the most important professions others are added constantly. Maximal non-taxable minimum can be 3 600 EUR per year.

You will get a 14-page downloadable report calculating the salary youll need. Most people will come under rate A B or C. ---Select Grade--- USG ASG D-2 D-1 P-5 P-4 P-3 P-2 P-1 FS-7 FS-6 FS-5 FS-4 FS-3 FS-2 FS-1 The grade station is required.

The total deductions include all listed deductions excluding the contributions for your health insurance. A direct overview of salaries and wages in Switzerland. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Spain affect your income.

Calculate the salary that you will need in Geneva based on the cost of living difference with your current city. The wage calculator was developed in the context of the flanking measures to the free movement of persons between Switzerland and the European Union. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in France affect your income.

If salary is more than 21 600 EUR per year above 1 800 EUR per month non. If you have several debts in lots of different places credit cards car loans overdrafts etc you might be able to save money by consolidating them into one loan. Youll then get a breakdown of your total tax liability and take-home pay.

With the calculator below you can calculate how much sourcetax you can expect to pay depending on your monthly gross salary. This marginal tax rate means that your immediate additional income will be taxed at this rate. Also known as Gross Income.

On the Federal Tax Administration website you can calculate the amount of income tax you will have to pay using the online tax calculator includes comparison between cantons. The average wages can be shown for the whole country by canton or by location. The Salary Calculator has been updated with the latest tax rates which take effect from April 2021.

The national wage calculator enables you to calculate a monthly gross wage central value or median and the spread of wages interquartile range for a specific individual profile. Youll then get a breakdown of your total tax liability and take-home pay. Your average tax rate is 168 and your marginal tax rate is 269.

You can calculate net salary in payroll calculator if gross salary is known. This places Ireland on the 8th place in the International Labour Organisation statistics for 2012 after United Kingdom but before France. Le calculateur de salaire en ligne sappuie sur les données.

The cross border rates are for people living in a neighboring country and commuting conditions apply so. Also known as Gross Income. The net salary and gross salary calculator on moneylandch makes it easy for you as an employee in Switzerland to find your net salary based on your gross salary and to find your gross salary based on your net salary.

Try out the take-home calculator choose the 202122 tax year and see how it affects your take-home pay. Thanks to the salary calculator of jobsch you can compare the average salary for all common professions in Switzerland.

Dental Average Salaries In Switzerland 2021 The Complete Guide

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

Workshop On The Post Adjustment System Ppt Download

Salary And Benefits Calculator Now Available Hr Portal

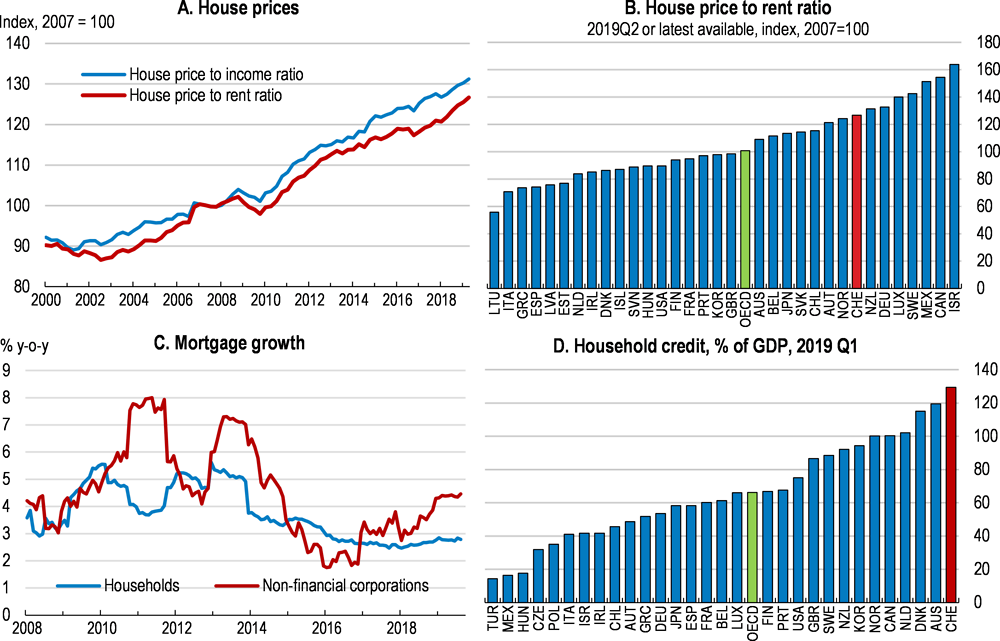

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

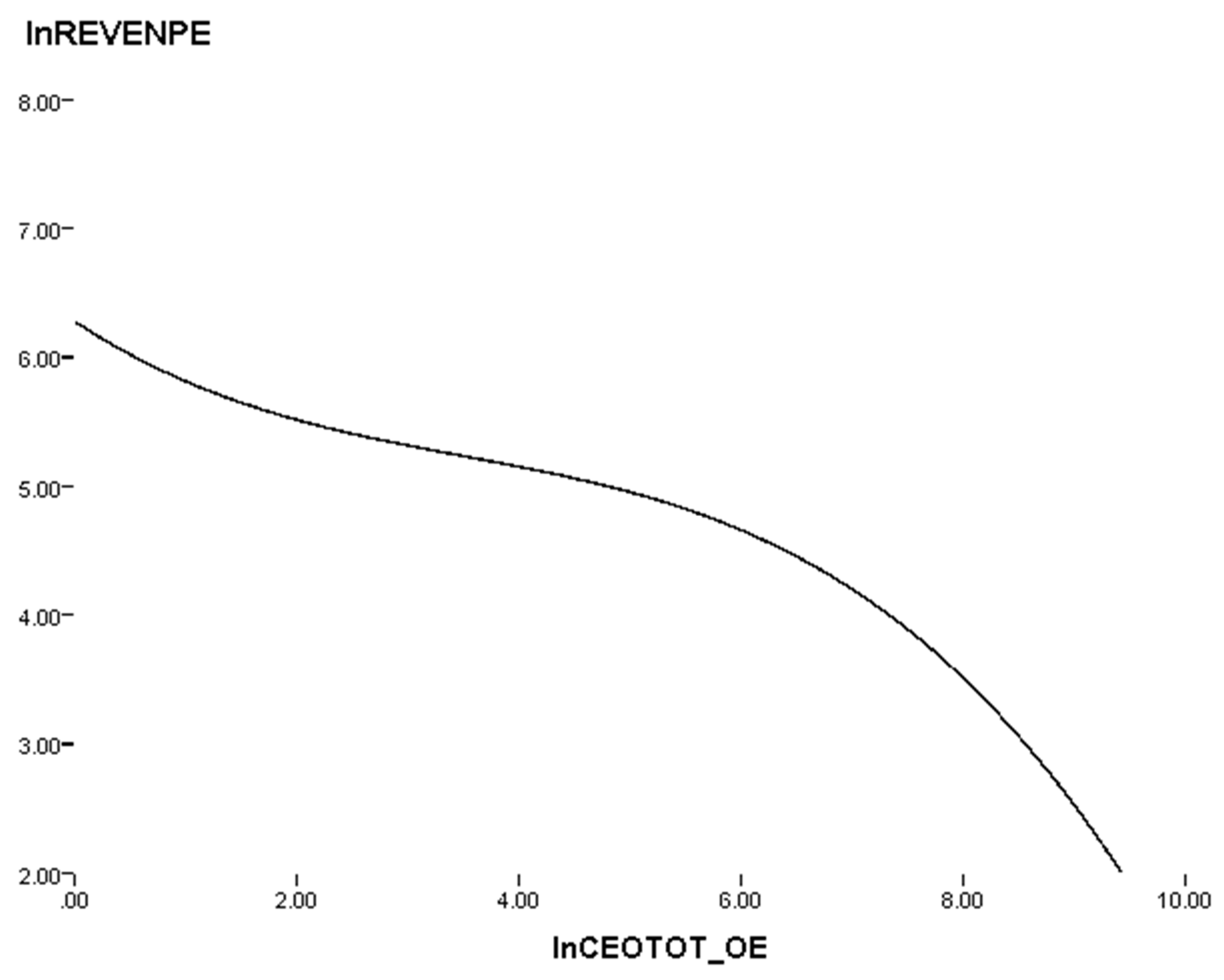

Jrfm Free Full Text Ceo Employee Pay Gap Productivity And Value Creation Html

Https Www Insee Fr En Statistiques Fichier 2647434 491 492 Martin En Pdf

Ctr Calculator Click Through Rate The Online Advertising Guide Online Advertising Marketing Budget Email Marketing Campaign

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Is 120 000 Chf Gross Salary A Good Salary To Live In Lausanne For A Single Person Quora

Ebit Vs Operating Income Infographics Here Are The Top 5 Difference Between Operating Income Vs E Money Management Advice Learn Accounting Financial Management

Canada Pension Plan Calculator Canada Pension Plan Pension Plan How To Plan

Key Policy Insights Oecd Economic Surveys Switzerland 2019 Oecd Ilibrary

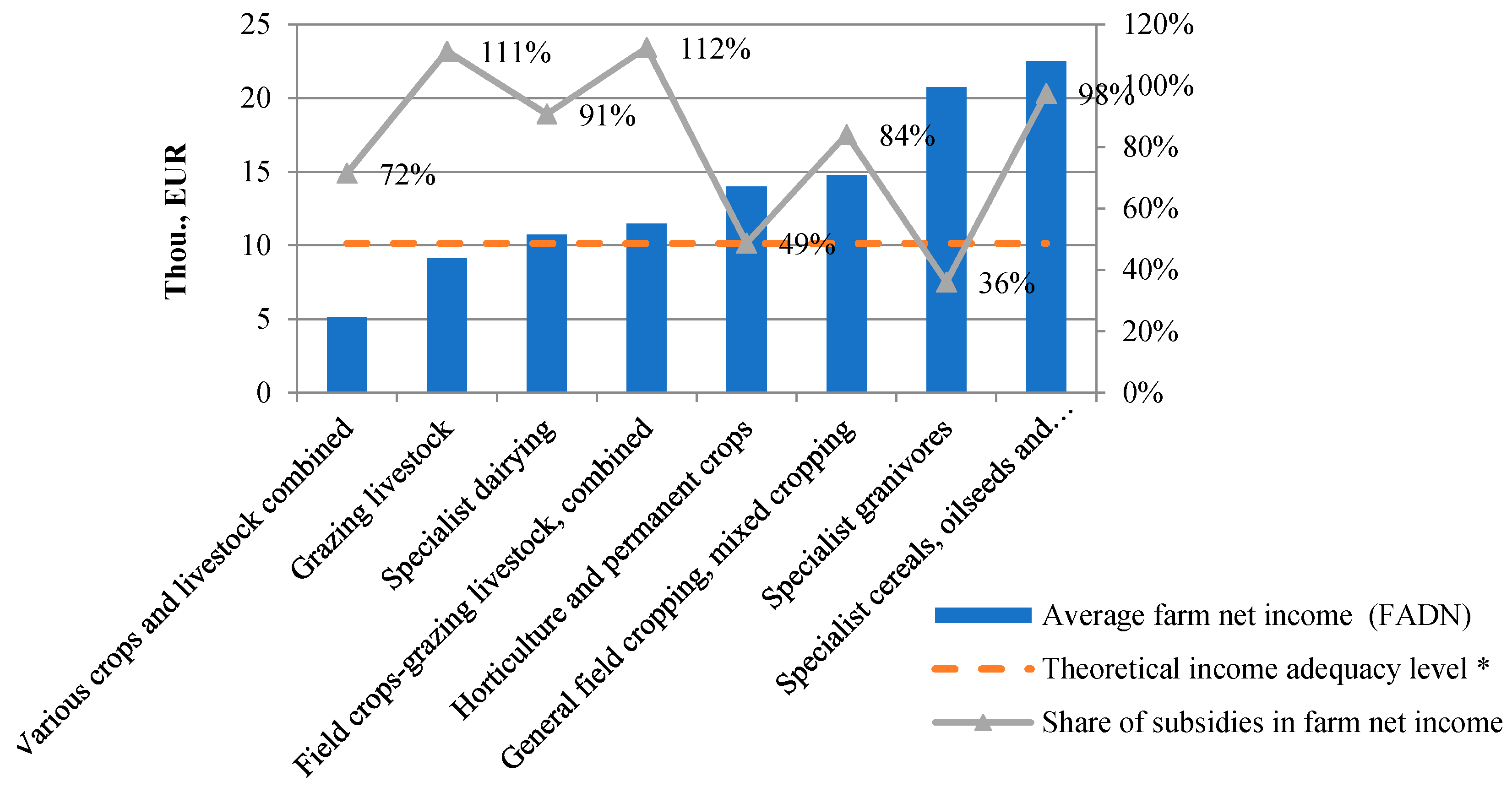

Sustainability Free Full Text Who Benefits From Cap The Way The Direct Payments System Impacts Socioeconomic Sustainability Of Small Farms Html

Alabama Income Tax Calculator Smartasset

Pdf The Impact Of The Coronavirus Outbreak Covid 19 On Player Salaries Transfer Fees And Net Transfer Expenses In The English Premier League

Workshop On The Post Adjustment System Ppt Download

Is 120 000 Chf Gross Salary A Good Salary To Live In Lausanne For A Single Person Quora

Java Program For Salary Calculation Of Employee Salary Computer Programming Programming

Post a Comment for "Net Salary Calculator Geneva"