Salary Sacrifice Limits

The minimum your employer must contribute is 3 in the UK though they can choose to contribute more. If however the sacrifice lowers your earnings below the National Living Wage then the scheme wont be available to you.

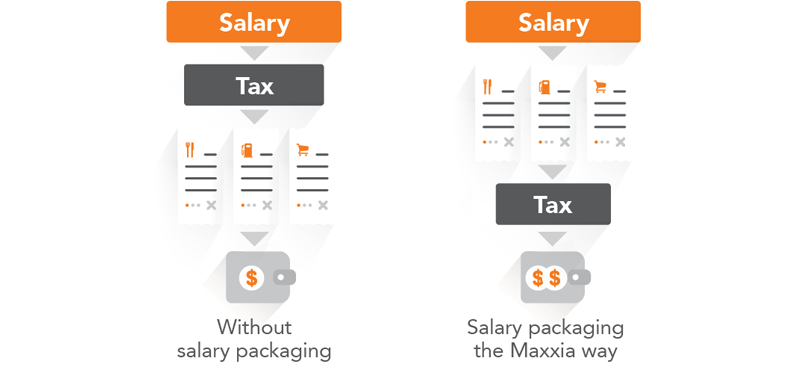

Motor Vehicle Salary Packaging How Much Can You Save

Its what has helped make salary sacrifice the cheapest way to own an electric car.

Salary sacrifice limits. For battery-electric cars BIK tax is 1 for 202122 and 2 for. Salary sacrifice comes at no additional cost to you or your employer and there are several tax benefits for both parties. BIK is the value of the benefit you receive in this case a car.

Unlike some other benefits that you might take through salary sacrifice an electric vehicle isnt taxed based on the salary that you give up. The taxable value of the car for FBT purposes grossed-up by the Type 2 factor is 6350. If youre part of a workplace pension you and your employer will contribute every month.

Your employer will also save money as they wont have to pay Employers National Insurance Contributions on the. Salary sacrifice and tax. From 1 July 2019 recent retirees aged between 65-74 are able to make non-concessional contributions to super without meeting the work test for 12 months after the financial year in which they last met the work test if they have a superannuation balance below 300000.

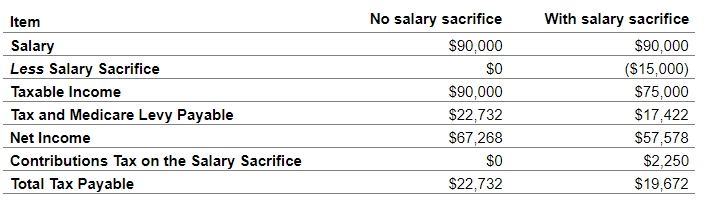

Is there a limit on the amount that can be sacrificed under a salary sacrifice arrangement. Its also important to note that contributions made into your super as part of a salary sacrifice arrangement are not the only contributions that count toward this cap. Potential benefit of salary packaging living expenses based on an eligible employee salary packaging the full cap limit of 15900.

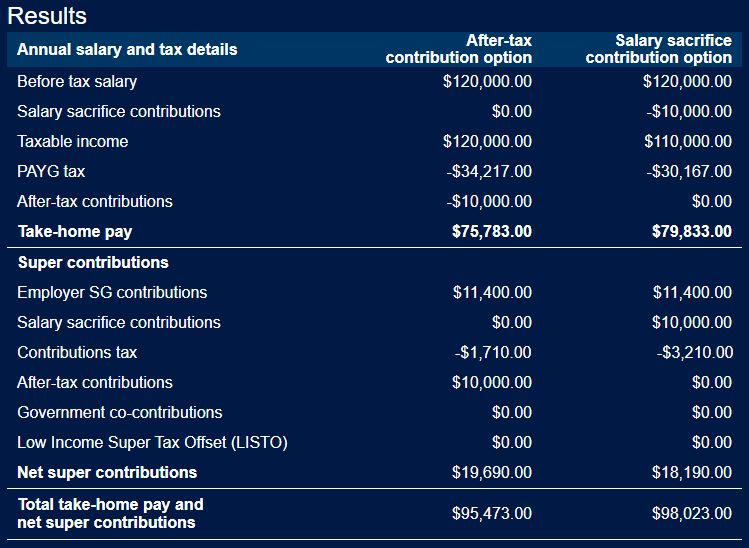

Theres no limit on how much you can salary sacrifice into super. Unless there are limitations specified in the terms of your employment there is no limit to the amount you can salary sacrifice into super. When you salary sacrifice you agree to reduce your earnings by an amount equal to your pension contributions.

If your employer offers a salary sacrifice scheme then you should be able to enroll in it. Instead you pay tax on the value of the benefit in kind BIK tax. To find out if youre eligible speak to your employer get in touch online or give us a call on 1300 123 123.

It means that contributions from your employer increase except that they are really your own contributions because your salary. However its important to consider your concessional contributions cap. The total limits for tax benefits on payments into a salary sacrifice pension scheme include an employees total pension pot and is currently capped at 40000 per year before additional taxes are incurred for basic rate taxpayers.

The salary sacrifice adjusted gross pay then provides a full tax calculation and includes personal tax allowances calculates your National Insurance Contributions and Your employers National Insurance Contributions deductions PAYE etc. Salary sacrifice limitations. As a result their salary will be reduced to 58000 per year.

It is important to note the rules around salary sacrifice schemes for low paid workers. Employers must make sure that participation in a salary sacrifice scheme should not reduce an employees cash earnings hourly rate to below the National Minimum Wage. However you should also consider whether the amount you wish to salary sacrifice.

For more information please see HMRC guidance on salary sacrifice. One way to increase these contributions is via a salary sacrifice scheme. FBT rates effective 1 April 2018 and PAYG tax rates effective 1 July 2018 have been used.

When you give up part of your wages through a salary sacrifice scheme youll pay less tax and national insurance on your gross earnings. Payroll tax will be payable on the 58000 salary and the FBT taxable value of 6350. What is a salary sacrifice pension.

Salary sacrifice is not likely to affect your entitlement to the state pension unless your lowered salary is under the threshold to make National Insurance contributions. And provides a breakdown of your annual salary. If this is the case then the employee is not entitled to participate in the scheme.

Yes salary sacrifice cant take the employee below the minimum wage. You starting amount for the state pension may also include a deduction if you were in certain earning-related pension schemes before 6 April 2016 or had certain workplace personal or stakeholder pensions before 6. This is currently 25000.

Each salary sacrifice calculator allows you to enter salary sacrifice as a fixed amount of a percentage of your Gross pay. You cant therefore claim additional tax relief because as an employee youve been taxed on a lower amount of salary. You cant contribute more than 25000 per year under the concessional super contributions cap or penalties will apply.

An employee with a current salary of 70000 per year negotiates with their employer for the provision of a car under a salary sacrifice arrangement.

Salary Sacrifice Alphington Private Wealth

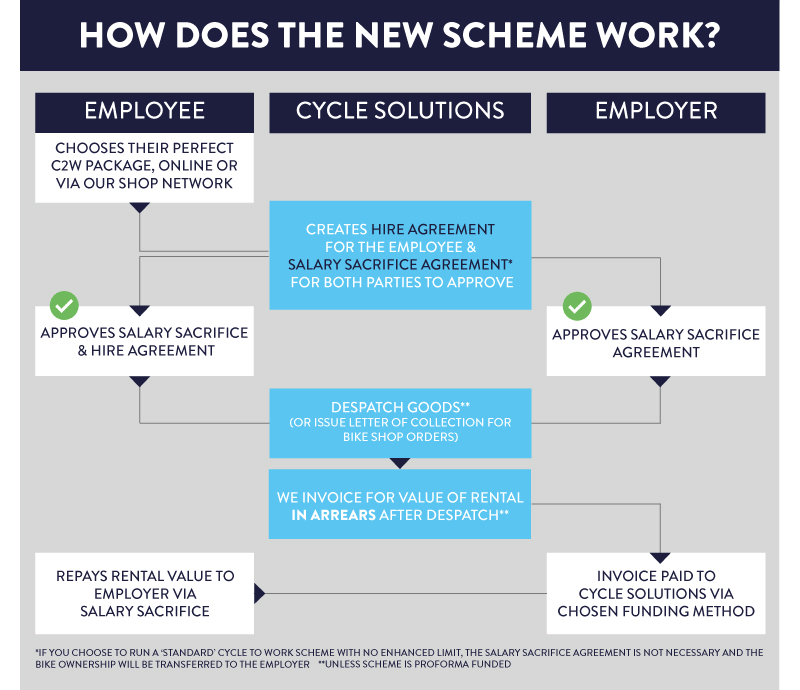

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

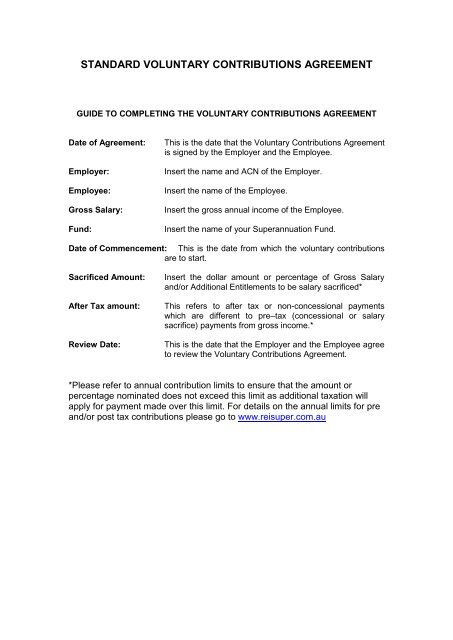

Standard Salary Sacrifice Agreement Rei Super

What You Need To Know About The Upcoming Changes To Salary Sacrifice Super Offsets Payroll Support Au

Standard Salary Sacrifice Agreement Rei Super

Salary Sacrifice Pension Scheme How It Works Benefits

Content Mercer Super Trust Australia

Is Salary Sacrifice Concessional Or Non Concessional Super Guy

Government Limits Tax Efficient Salary Sacrifice Arrangements Employee Benefits

Https Www Csc Gov Au Media Files Militarysuper Factsheets Ms16 Salary Sacrifice Contributions Pdf

Peakwm Seven Things You Need To Know About Salary Sacrificing

Employer How Does Salary Sacrifice And The Cycle To Work Scheme Work For Employers Cyclescheme Knowledge Base

Https Www Ngssuper Com Au Files Documents Salary Sacrifice Pdf

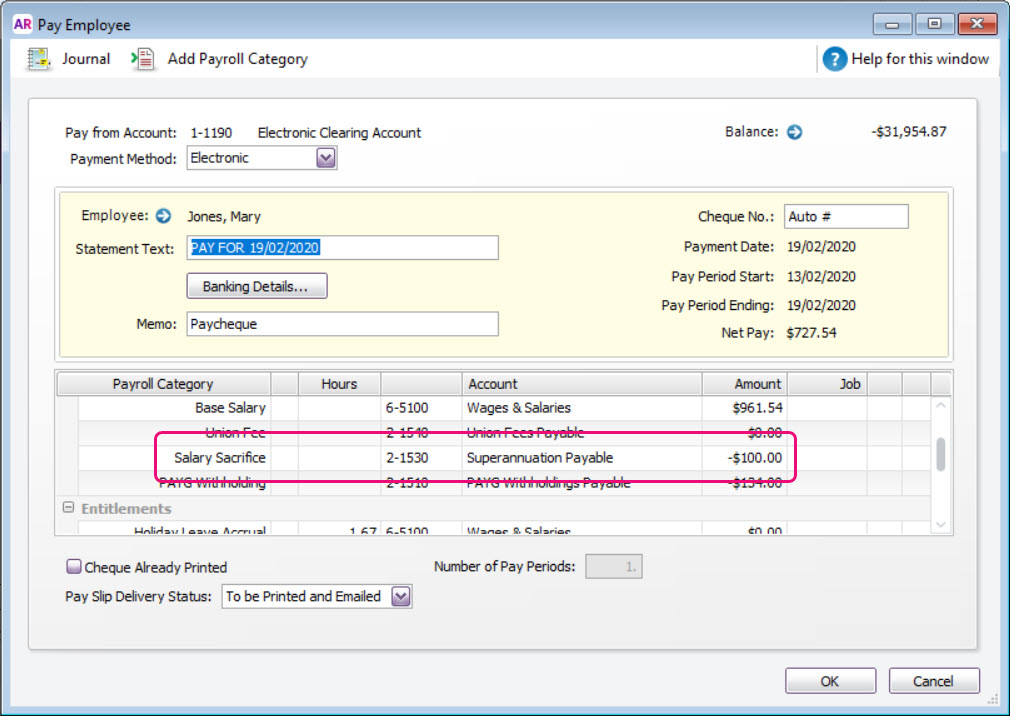

Set Up Salary Sacrifice Superannuation Myob Accountright Myob Help Centre

Superannuation And Salary Sacrifice Two To Fire

Cycle To Work Scheme Guidance Update Cycle Solutions

Https Qsuper Qld Gov Au Media Pdfs Qsuper Public Forms Fo25 Pdf

Post a Comment for "Salary Sacrifice Limits"