Gross Annual Income Definition And Meaning

1 For companies gross income is interchangeable with gross margin or. Gross annual income nom revenu annuel brut m usage quasi-systématique.

What Is Gross Income For A Business

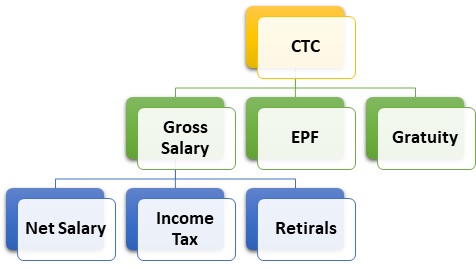

The gross salary may differ from employee to employee on the basis of their salary band nature of job industry type merit and seniority.

Gross annual income definition and meaning. Gross income which is also known as gross pay before tax pay or pre-tax income is the income that an individual makes before taxes. Gross annual income meaning. If your pay is the same amount each time you receive a paycheck.

The total amount of a persons or organizations income in a one-year period before tax is paid on. Gross income is the total income of an individual before any deductions. This is the figure which Compliance enter on the Charity Database from information included in the Annual.

The total amount of a persons or organizations income in a one-year period before tax is paid on. The valuation of gross income is the first step in computing whether. Gross Annual Income Definition.

The total amount of a persons or organizations income in a one-year period before tax is paid on. Cherchez des exemples de traductions gross annual income dans des phrases écoutez à la prononciation et apprenez la grammaire. The first thing to figure out is whether you receive pay by the hour or by the year.

Gross annual income definition. Total expenditure means the total gross recorded expenditure of the charity for the financial year. It will also include profit or loss carried forward from past years and any income after clubbing provisions.

Your gross income is the total amount of money you receive annually from your monthly gross pay. You can usually find gross income as a line on a paycheck or W-2. Here are a few simple steps you can follow to help you determine your own annual gross income.

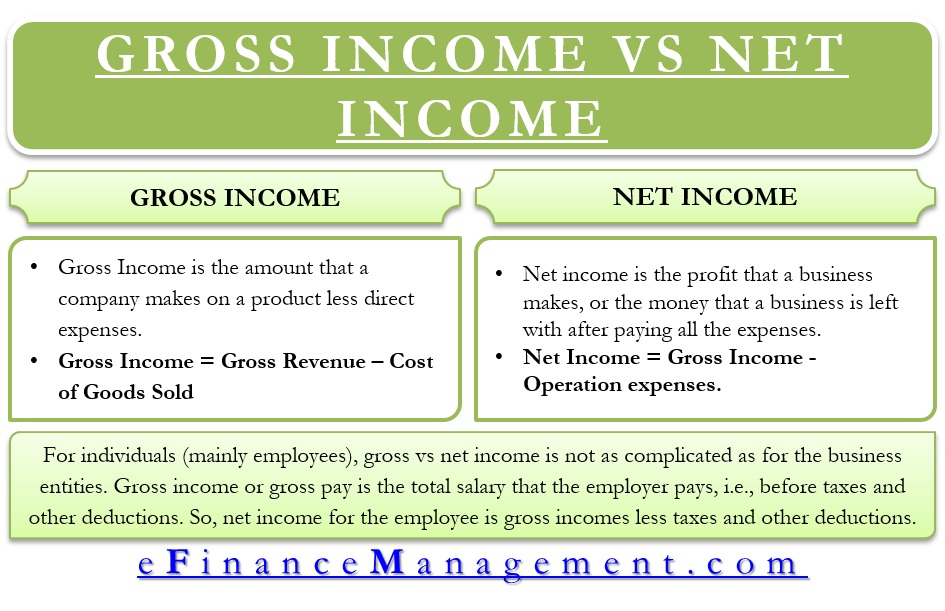

An individual or companys income before taxes and deductionsFor individual income it is calculated as the individuals wages or salary investment and asset appreciation and the amount made from any other source of incomeIn a company it is calculated as revenues minus expensesAn individuals gross income is important to determining eligibility for certain social programs while a. Gross annual income définition signification ce quest gross annual income. This concept is normally used for individuals.

The financial gains received by an individual or a business during a fiscal year. In simple terms Gross Total Income is the aggregate of all your taxable receipts in the previous year. Gross income includes any wages properties or services received before taxes and deductions.

Gross Salary refers to the actual amount that an employee receives prior to any deductions. This income is also called as Gross pay and its the total amount an individual receives from his or her employer before any kind of deductions. Gross annual income is the amount of money a person earns in one year before taxes and includes income from all sources.

Gross annual income refers to all income you receive in the form of money goods property and services that is not exempt from tax during the calendar year according to the Internal Revenue Service the federal tax collection agency of the United States government. Determine how youre paid. But will not include any deductions from section 80C to 80U.

It is an individuals income in one year while heshe is working with the employer. The accounts of a charity should be audited if the gross annual income or expenditure exceeds 250000 in the relevant year or in either of the two years immediately preceding the relevant year. For Income Tax purposes gross income includes any type of monetary benefit paid to an individual or business whether it be earned as a result of personal services or business activities or produced by investments and capital assets.

Operating income also called income from operations takes a companys gross income which is equivalent to total revenue minus COGS and subtracts all operating expenses. Vérifiez les traductionsgross annual income en Français. As for companies we use the concept of Gross Profit or Gross margin.

How to calculate your annual gross income. Your gross annual income and gross monthly income will always be larger than your net income.

The Difference Between Gross And Net Pay Economics Help

What Is Base Salary Definition And Ways To Determine It Snov Io

What Are Gross Wages Definition And Overview

Gross Income Definition Formula Examples

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Annual Income Learn How To Calculate Total Annual Income

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Definitions Of A Middle Class Income Consider Yourself Middle Class

Gross Vs Net Income Importance Differences And More Bookkeeping Business Accounting And Finance Finance Investing

Gross Income Formula Step By Step Calculations

Difference Between Gross Income Vs Net Income Definitions Importance

Taxable Income Formula Examples How To Calculate Taxable Income

:max_bytes(150000):strip_icc()/ExxonIncojmestatement2019June-55cdf08720b24bc7b27ade3de5b6dc32.jpg)

What Is The Difference Between Revenue And Sales

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Taxable Income Formula Examples How To Calculate Taxable Income

Post a Comment for "Gross Annual Income Definition And Meaning"