Gross Annual Income Tax Calculator

Are calculated based on tax rates that range from 10 to 37. To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator.

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

But that 10 is calculated after deductions.

Gross annual income tax calculator. Other Tools Payroll Software GST Calculator. The calculator uses necessary basic information like annual salary rent paid tuition fees interest on childs education loan and any other savings to calculate the tax. You will need to use the estimator to calculate your gross pay for each pay period that you do not know and then total them separately.

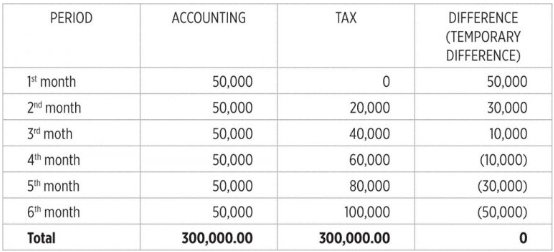

This marginal tax rate means that your immediate additional income will be taxed at this rate. We all know that tax is charged levied on an individuals income. So your taxable income is not the whole gross income and resident tax is calculated on your taxable income.

The higher is your income the closer is your resident tax is to actual 10 because of smaller deductions. The Income Tax Department NEVER asks for your PIN numbers passwords or similar access information for credit cards banks or other financial accounts through e-mail. These include income tax as well as National Insurance payments.

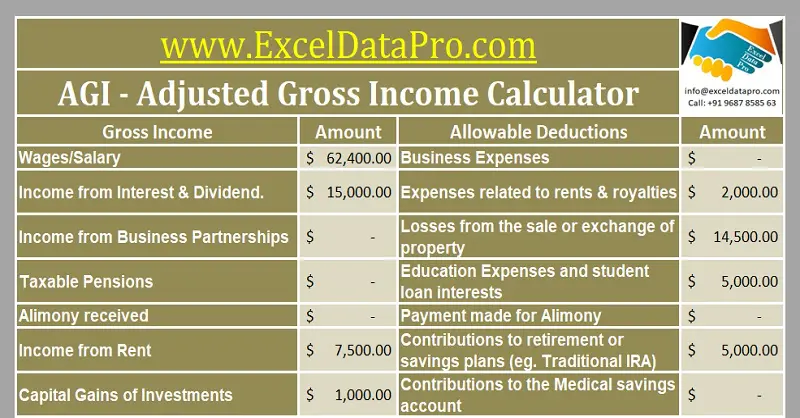

AGI and MAGI matter because many tax deductions and credits are available only if your AGI or MAGI falls below a certain number. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary Net annual salary Weeks of work year Net weekly income. Formula for calculating net salary The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Use the calculator to work out an approximate gross wage from what your employee wants to take home. Its so easy to use. See how to calculate your AGI and MAGI.

The calculator is not applicable for the qualifying. The UKs income tax and National Insurance rates for the current year are set out in the tables below. A financial advisor can help you understand how taxes fit into your overall financial goals.

You can calculate your property tax from five preceding years up to the following year. Income tax calculator for non-resident individuals XLS 67KB. Our simple salary calculator gives an estimate of your take-home pay after your employer has made deductions from your gross salary.

Based on your experience today how likely would you be to. Calculate how tax changes will affect your pocket. Information you need for this calculator.

Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Tax in itself is a tedious phenomenon and the complexity increases when various terms are also included in the list. Budget Financial Toolbox PAYE Calculator Budget Savings Net Worth Retirement User Profile.

The result in the fourth field will be your gross annual income. Before you use this calculator. Income taxes in the US.

The Income Tax Department appeals to taxpayers NOT to respond to such e-mails and NOT to share information relating to their credit card bank and other financial accounts. Your profile has been updated. However the pay can further be classified and referred to.

Adjusted Gross Income AGI is your gross income minus all the adjustments to income you claim on your tax return. The calculator is updated for the UK 2021 tax year which covers the 1 st April 2021 to the 31 st March 2022. Taxpayers can lower their tax burden and the amount of taxes they owe by claiming deductions and credits.

Subtract your total deductions to your monthly salary the result will be your taxable income. The first four fields serve as a gross annual income calculator. Planning ahead can help you time your expenses to qualify for as many tax breaks as.

You can view the Annual Value of your property at myTaxirasgovsg. Your average tax rate is 221 and your marginal tax rate is 349. The calculator will help you estimate your Property Tax payable based on the Annual Value of your property.

If the amount of your pay differs from one period to another it is not possible to calculate the annual income based on the amount received on a single pay period. The Canada Annual Tax Calculator is updated for the 202122 tax year. The Annual Tax Calculator is our most comprehensive UK payroll tax calculator with features for calculating salary PAYE Income Tax Employee National Insurance Employers National Insurance Dividends Company Pension Deductions and more.

Net to Gross Salary Calculator At Stafftax we strongly advocate discussing and agreeing salaries in gross terms. An income tax calculator is a tool that will help calculate taxes one is liable to pay under the old and new tax regimes. Our online salary tax calculator is in line with changes announced in the 20212022 Budget Speech.

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400. Income tax is paid on your personal earnings. Simply enter your current monthly salary and allowances to view what your tax saving or liability will be in the tax year.

Gross Total Income GTI. In addition Social Security uses your adjusted gross income to help calculate how much of your Social Security benefits are taxable. Tax Code Annual Gross Pay Annual Take Home Pay Effective Tax Rate.

For instance an increase of 100 in your salary will be taxed 3491 hence your net pay will only increase by 6509. The system is based on marginal tax. You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax Tables.

The rates for have been applied. Yes it is 64 municipal prefectural. You need to insert an income before you can calculate.

Gross Income Vs Net Income Creditrepair Com

How To Create An Income Tax Calculator In Excel Youtube

Download Income Tax Calculator Fy 2018 19 Excel Template Exceldatapro

Salary Formula Calculate Salary Calculator Excel Template

How To Calculate Income Tax In Excel

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Calculator Examples With Excel Template

Paycheck Calculator Take Home Pay Calculator

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Know Your Worth 7 Salary Calculators Tools To Compute Your Earnings

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Annual Income Learn How To Calculate Total Annual Income

Download Adjusted Gross Income Calculator Excel Template Exceldatapro

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Salary Formula Calculate Salary Calculator Excel Template

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Tax Calculator Estimate Your Income Tax For 2020 And 2021 Free

45 000 After Tax 2021 Income Tax Uk

Post a Comment for "Gross Annual Income Tax Calculator"